This blog submission is provided by our friends from the George Bradley Team at RBC Wealth Management to help with your estate planning education. |

George Bradley, B.A. Investment Advisor george.bradley@rbc.com | 905-332-2706

As part of the estate planning process, individuals will often consider establishing a joint account with one or more of their adult children or other family members. Sometimes, this is done as a tool for expediency so that a joint account holder can help to manage the account, or to make the assets immediately available to the surviving accountholder(s) upon the death of the first joint accountholder. In other cases, a joint account is a planning technique used as part of a strategy recommended by an individual’s legal and tax advisors to seek to minimize probate tax. Whatever your motivation, before you open a joint account it is important to be aware of the different types of joint accounts available, how these different accounts operate, and the resulting potential benefits and considerations for each type. It is also important to consider how a joint account fits into your overall holistic estate strategy. There may be other estate planning tools that are more appropriate in light of your current or future estate goals.

This article may outline strategies, not all of which will apply to your particular financial circumstances. The information in this article is not intended to provide legal or tax advice. To ensure that your own circumstances have been properly considered and that action is taken based on the latest information available, you are advised to obtain professional advice from a qualified legal and tax advisor before acting on any of the information in this article.

Please note: any reference to a spouse in this article also includes a common-law partner.

Joint tenancy vs Tenancy in common

There are generally two forms of shared ownership which allow for two or more people to own an asset together: Tenancy In Common and Joint Tenancy.

Tenancy in common

The term “tenancy in common” is used to describe the ownership of an asset by two or more individuals together, but without the right of survivorship. Each accountholder is entitled to a defined, possibly unequal, portion of the account in question. In other words, co-owners in a tenancy in common arrangement can own equal or unequal interests in an asset. Upon the death of one of the accountholders, his/her interest will not pass to the surviving accountholder(s), but will form part of the deceased’s estate and will be distributed in accordance with his/her Will. If the deceased accountholder did not have a Will then the provincial or territorial intestacy laws will dictate how the assets of the deceased will be distributed.

Joint tenancy

Joint tenancy allows two or more people to own an asset together where each joint accountholder generally has an equal undivided interest in the account. Where the joint tenancy is between spouses, upon the death of one spouse, the deceased’s ownership interest in the account automatically passes to the surviving spouse. By passing directly to the surviving spouse, the account does not form part of the deceased spouse’s estate and thus would generally not be subject to probate fees.

Where the joint tenancy is between a parent and adult children, upon the death of the parent, the account may be considered to form part of the deceased parent’s estate. The adult children will be required to demonstrate that the parent intended to gift the account and its assets to them, as opposed to having added the children to the account for the purpose of ease of account administration. Where the adult children so demonstrate, the account will generally pass to them as surviving joint tenants. Otherwise the account forms part of the deceased parent’s estate and may be subject to probate.

The following is a non-exhaustive list of the matters which may assist in determining the parent’s intention:

What was said and done by the parties before or at the time of the transfer or immediately after it.

The language used in any bank or financial institution documents pertaining to the account.

Control and use of the funds in the accounts during the parent’s lifetime.

The tax treatment of the joint account. Was the income and capital gains generated by the investments in the account reported solely by the parent or by all joint accountholders?

Evidence of the parent’s intention to gift the account to the children.

Types of joint tenancy accounts

There are two types of joint tenancy accounts available at RBC Dominion Securities: Joint Tenants with Right of Survivorship (JTWROS) and Joint – Gift of Beneficial Right of Survivorship (JGBRS).

Please NoteThe following accounts are not available to residents of Quebec. A Quebec resident is not permitted to be an accountholder or successor accountholder of the following types of accounts. |

Joint Tenants with Right of Survivorship (JTWROS)

By opening a JTWROS account and agreeing to the terms of the client account agreement, it is assumed by RBC Dominion Securities that all joint accountholders have both legal and beneficial ownership of the account. What this means is that not only are the accountholders the registered legal owners of the account, but all joint accountholders have beneficial ownership of the account, including the assets of the account, as soon as the account is opened. On the death of one of the joint accountholders, the JTWROS account will be treated in accordance with the applicable client account agreement and account opening forms and the name of the deceased will be removed from the account so that the JTWROS is subsequently held in the name(s) of the surviving joint accountholder(s) without requesting probate. Although RBC Dominion Securities will generally not require probate as described above, these assets may need to be included in an application for probate should the executor of the deceased accountholder apply for probate or should a third party make a claim upon the assets of the account. It is important you discuss this matter with a qualified legal advisor before opening a JTWROS account.

Joint – Gift of Beneficial Right of Survivorship (JGBRS)

RBC Dominion Securities JGBRS is a joint account which facilitates the retention by the primary accountholder of legal and beneficial ownership of the account, including the assets of the account, during his/her lifetime, while gifting the beneficial entitlement to the right of survivorship in the account to any friends and family members named as successor accountholder(s).

The terms of the RBC Dominion Securities client account agreements governing the JGBRS account expressly state that the intention of the accountholder at the time of account opening is to make an inter-vivos gift, at the time of the account opening, the beneficial entitlement to the right of survivorship in the account. Neither the account nor the assets therein are gifted at the time of account opening. This means that the successor accountholder(s) does not have any entitlement to or control over the account or its assets until the death of the primary accountholder. The successor accountholder(s) is not permitted to provide any instructions in relation to the account while the accountholder is alive or to withdraw funds from the account. Accordingly, the accountholder retains sole control of the account during his/her lifetime.

On the death of the accountholder, the JGBRS account will be treated in accordance with the applicable client account agreement and account opening forms and the name of the deceased will be removed from the account so that the JGBRS is subsequently held in the name of the successor accountholder(s) without requesting probate. Although RBC Dominion Securities does not require probate to allow the assets to pass to the successor accountholder(s), these assets may need to be included in an application for probate should the executor of the deceased accountholder apply for probate or should a third party make a claim to the assets in the account. It is important that you discuss this matter with a qualified legal advisor before opening a JGBRS account.

Key considerations before transferring assets into a joint account

Ability for the deceased accountholder’s estate to pay taxes at death

Consider the potential tax implications of the following example:

EXAMPLEMr. X owns a non-registered investment account with a fair market value of $2MM, a house worth $400K and an RRSP valued at $1MM. He has designated his wife as the beneficiary of his RRSP. Mr. X opens a JGBRS account and transfers his non-registered investment account into it, naming his 3 daughters as Successor Accountholders. Upon his death, his 3 daughters receive the assets in the JGBRS outright. However, a $750K tax liability is triggered on the deemed disposition of the assets in the JGBRS account that is payable by Mr. X’s estate. As the bulk of Mr. X’s assets did not fall into his estate (only the $400K house formed part of the estate), there would be insufficient assets in his estate to pay the taxes owing. The executor of the estate would be faced with a liquidity issue and a potentially bankrupt estate. |

Lack of flexibility in making gifts and potential unintended consequences

There is no limit to the number of joint potential accountholders (JTWROS account) or successor accountholders (JGBRS account). However, the surviving joint accountholders may only receive the assets in the account in equal shares. There is no ability to specify the percentage share received by each surviving joint accountholder, which would limit your ability (as the accountholder) to gift assets to friends and family in differing proportions. Furthermore, any funds held in a JTWROS account or a JGBRS account would likely be unavailable to fund charitable bequests set out in your Will as the assets generally pass outright to the surviving joint accountholder(s) and do not form part of your estate.

Both the JTWROS and JGBRS accounts only benefit joint accountholders that are living at the time of your death, leaving no entitlement to the heirs of a joint accountholder who has died before you. The assets in the JTWROS and JGBRS account will pass to the joint accountholder(s) alive at the time of your death in equal shares. There is no ability to name contingent beneficiaries in the event a joint accountholder predeceases you. This may be avoided by leaving the assets in your sole name and having the assets pass through your estate and distributed in accordance with your Will.

In the case of the JGBRS account, where the successor accountholder predeceases you, you could change the distribution by withdrawing the assets of the account, closing the account and opening a new JGBRS account with newly named successor accountholders. Note that changes to an account will not be possible where you are deemed to no longer have mental capacity. Moreover an attorney appointed pursuant to an enduring power of attorney is not permitted to make changes to a joint account.

In the event there are no surviving successor accountholders following your death, your assets would form part of your estate and will be distributed in accordance with your Will.

Alternative estate planning vehicles and other strategies to consider

There may be estate planning vehicles or strategies other than a joint account that are more appropriate in light of your current or future estate planning objectives. Such vehicles and strategies may include creating an alter ego trust or joint partner trust, setting up a testamentary trust in your Will, making an outright gift to adult children, or being the donor of a Power of Attorney.

Alter ego trust or joint partner trust

An alter ego trust (or a joint partner trust, if you wish to include your spouse as a beneficiary of this trust) is an inter vivos trust created by you when you are aged 65 or older. The terms of the trust must provide that you (or your spouse in the case of a joint partner trust) are entitled to receive the income of the trust while alive and that no other person other than you (or your spouse) can receive or use the income or capital of the trust during your (or your spouse’s) lifetime.

One of the benefits of creating this trust is that you can generally transfer your capital property into this trust on a tax deferred basis. Any taxes on the accrued gains on the property transferred to the trust will be deferred until the property is subsequently sold or you (or your spouse in the case of a joint partner trust) die. This differs from the normal tax treatment when assets are transferred to an inter vivos trust, where you are immediately deemed to have disposed of your property at fair market value.

Another benefit to creating an alter ego or joint partner trust is that the assets placed in the trust will generally not form part of your (or your spouse’s) estate on death and will not be subject to probate taxes. The terms of the trust document will determine how your assets are distributed after your (or your spouse’s) death.

There are considerations relating to these types of trusts, such as the set up and administration costs, as well as the complexity of administering these trusts. You can choose to name an Estate & Trust Service (such as the one RBC offers) or your estate lawyer as sole trustee, co-trustee, agent for trustee, or successor trustee. This provides the benefit of professional advice and administrative support when dealing with potentially complex family dynamics. Before transferring your assets to an alter ego trust or joint partner trust, you are advised to consult with a qualified legal and tax advisor.

Testamentary trust

A testamentary trust is a trust created by your Will which comes into effect on your death. It is generally funded with assets that form part of your estate. A testamentary trust is an alternative to a direct or outright distribution of estate assets. It provides means of transferring your assets to your intended beneficiaries, while allowing you to control the timing and distribution of the assets to them. The assets held in the trust are invested and managed by the trustee of the trust, who distributes the income and capital to the beneficiaries in accordance with your wishes stated in your Will. A testamentary trust also may assist with respect to potential claims of your beneficiaries’ creditors. You are advised to speak to your legal advisor in relation to this matter, as well as any matter relating to testamentary trusts.

You may wish to consider a testamentary trust if you have concerns about your children’s ability to manage finances or if you wish to provide a lasting legacy to your children, grandchildren and great grandchildren.

Outright gift

You may wish to consider a gift of assets outright to your adult children during your lifetime if you will not need the assets to support your living expenses. In this case, the gifted assets will generally not be included in the calculation of probate fees on your death. This strategy may suit your needs if you are comfortable giving up control of the assets and placing them in the control of your adult children. This also may appeal to you if you would like the next generation to benefit from your gift during your lifetime and you are comfortable that your adult children will manage the funds appropriately. There could, however, be tax and other consequences for you when you transfer the assets to your children so you are advised to obtain professional legal and tax advice before proceeding with this strategy.

Granting a Power of Attorney or a trading authority

If your intention in creating a joint account is to make it convenient for an adult child to manage your property, consider giving your adult child a Power of Attorney, which will allow your adult child to deal with the assets of your account for your benefit during your lifetime. Thereafter the assets of the account will form part of your estate. This will give you some certainty that on your death the assets in the account will go to your heirs in accordance with your wishes expressed in your Will. Another way to allow an adult child to assist you in managing your account is to grant trading authority (a form of limited power of attorney) over the assets in that account. This authority will not affect the way in which assets pass on your death, or your ability to continue to manage your assets during your lifetime. It will, however, enable your adult child, or any other person you choose to appoint, to make trading decisions on your behalf, within the parameters of the trading authority, which you have defined and granted. Your advisor will be able to discuss the types of authority available and the powers the different authorities can provide. For further information about different powers of attorney, check out Carson Law’s Legal Learning Centre.

Comparing joint account options

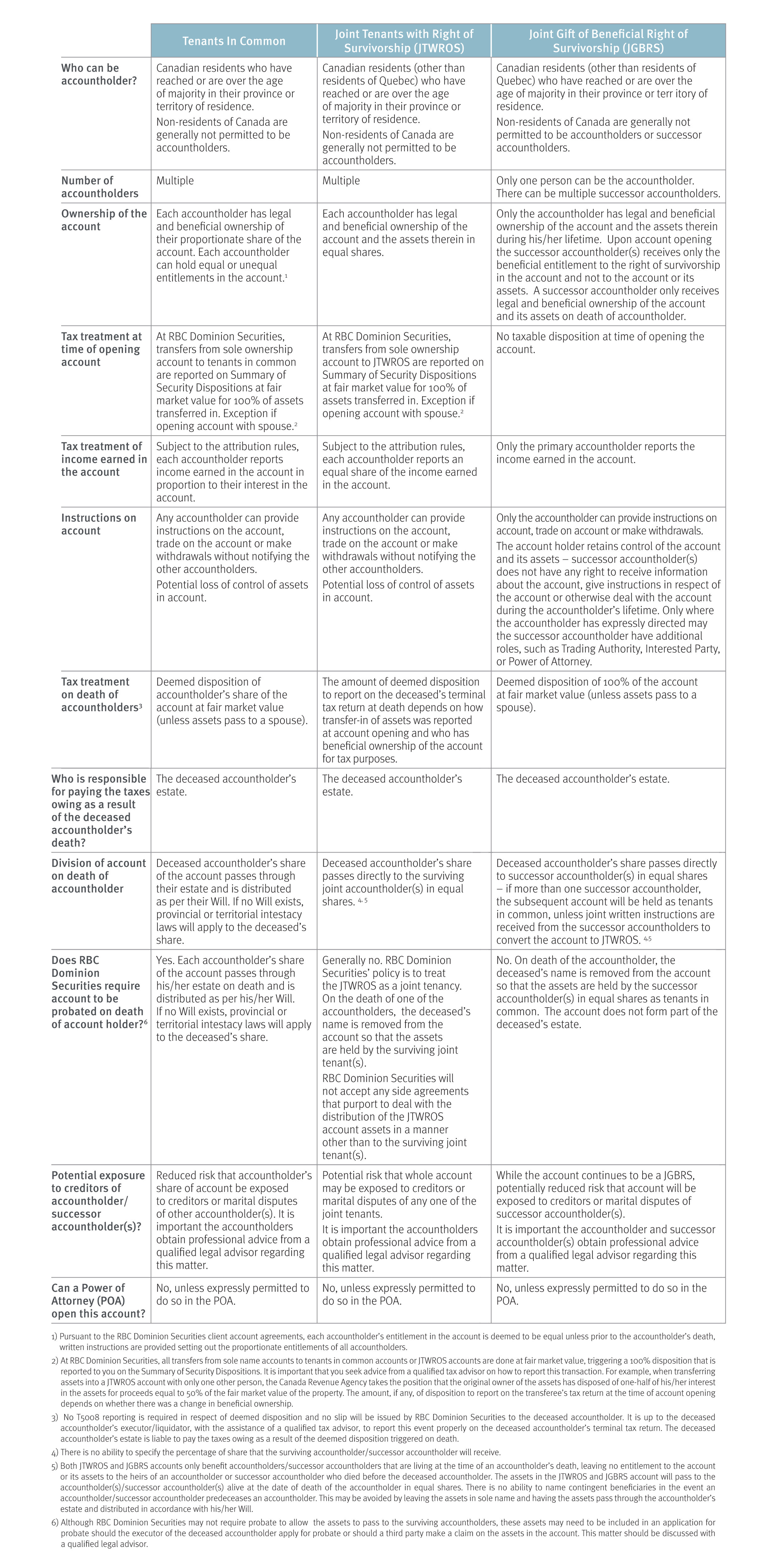

For a comparison of the joint ownership accounts discussed in this article, please refer to the chart below. This chart highlights some of attributes of the different types of joint ownership accounts including probate considerations as well as taxes on account opening and death. We recommend you discuss these features with an independent, qualified legal advisor who may assist you in determining which account, if any, may be suitable in meeting your estate planning and financial objectives.

Above you will find a summary of the three types of joint ownership accounts available at RBC Dominion Securities. The chart highlights some of the attributes of the different types of joint ownership accounts and may assist your legal advisor in guiding you in determining which account, if any, may be suitable in meeting your estate planning objectives.

Choosing the right option for youShould you choose to proceed with a joint account, it is important that you ensure that the account attributes align with your current and future estate planning objectives. To ensure that your circumstances have been properly considered, you are advised to obtain professional advice from a qualified legal advisor. As part of any estate planning process, it is also important to prepare your loved ones who are receiving the assets with the right financial guidance. This will help them to feel empowered with the knowledge, skills and confidence they need to make smart financial decisions with their assets and work towards reaching their own goals. RBC Dominion Securities advisors are available to assist in providing financial guidance as well as educational strategies for your loved ones. |

George Bradley, B.A. Investment Advisor george.bradley@rbc.com | 905-332-2706

This document has been prepared for use by the RBC Wealth Management member companies, RBC Dominion Securities Inc. (RBC DS)*, RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC), RBC Global Asset Management Inc. (RBC GAM), Royal Trust Corporation of Canada and The Royal Trust Company (collectively, the “Companies”) and their affiliates, RBC Direct Investing Inc. (RBC DI) *, RBC Wealth Management Financial Services Inc. (RBC WMFS) and Royal Mutual Funds Inc. (RMFI). *Member-Canadian Investor Protection Fund. Each of the Companies, their affiliates and the Royal Bank of Canada are separate corporate entities which are affiliated. “RBC advisor” refers to Private Bankers who are employees of Royal Bank of Canada and mutual fund representatives of RMFI, Investment Counsellors who are employees of RBC PH&N IC, Senior Trust Advisors and Trust Officers who are employees of The Royal Trust Company or Royal Trust Corporation of Canada, or Investment Advisors who are employees of RBC DS. In Quebec, financial planning services are provided by RMFI or RBC WMFS and each is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RMFI, Royal Trust Corporation of Canada, The Royal Trust Company, or RBC DS. Estate & Trust Services are provided by Royal Trust Corporation of Canada and The Royal Trust Company. If specific products or services are not offered by one of the Companies or RMFI, clients may request a referral to another RBC partner. Insurance products are offered through RBC Wealth Management Financial Services Inc., a subsidiary of RBC Dominion Securities Inc. When providing life insurance products in all provinces except Quebec, Investment Advisors are acting as Insurance Representatives of RBC Wealth Management Financial Services Inc. In Quebec, Investment Advisors are acting as Financial Security Advisors of RBC Wealth Management Financial Services Inc. RBC Wealth Management Financial Services Inc. is licensed as a financial services firm in the province of Quebec. The strategies, advice and technical content in this publication are provided for the general guidance and benefit of our clients, based on information believed to be accurate and complete, but we cannot guarantee its accuracy or completeness. This publication is not intended as nor does it constitute tax or legal advice. Readers should consult a qualified legal, tax or other professional advisor when planning to implement a strategy. This will ensure that their individual circumstances have been considered properly and that action is taken on the latest available information. Interest rates, market conditions, tax rules, and other investment factors are subject to change. This information is not investment advice and should only be used in conjunction with a discussion with your RBC advisor. None of the Companies, RMFI, RBC WMFS, RBC DI, Royal Bank of Canada or any of its affiliates or any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. ® Registered trademarks of Royal Bank of Canada. Used under licence. © 2017 Royal Bank of Canada. All rights reserved. NAV0217 (08/17)